Is Accounting Outsourcing Still Just About Cost or has It become something more?

As business complexity rises, U.S. companies, especially in financial centers like New York, Boston, and Chicago—are shifting their accounting strategies. What began as a tactical cost-saving measure has evolved into a cornerstone of smart business operations: accounting outsourcing.

In 2025, this shift is driven less by short-term financial pressures and more by long-term structural change: a historic labor shortage, rapid digitalization, and escalating regulatory demands. Together, these forces are pushing accounting departments and the CFOs who lead them, to rethink how work gets done, who does it, and where that work takes place.

Key Takeaways

- Outsourcing today is a strategic enabler, not just a cost-cutting tool.

- Internal controls, continuity, and scalability are among the most cited operational gains.

- CFOs use outsourcing to bridge talent gaps and accelerate digital transformation.

- Specialized expertise in tax, audit, and compliance is easier to access externally.

- Hybrid models (in-house + outsourced) are emerging as a best practice.

Accounting Outsourcing Is No Longer Optional, It’s Strategic

Outsourcing has evolved. Where it once meant farming out data entry or low-level reconciliation, today’s finance leaders are using outsourcing to fill knowledge gaps, maintain business continuity, and accelerate transformation.

A 2024 survey revealed that 90% of CFOs already outsource some portion of their accounting functions—and over one-third plan to increase that investment in the coming year.

This trend isn’t just about doing more with less. It’s about operating with resilience, agility, and strategic focus in an increasingly complex business environment.

1. Talent Crisis Are Reshaping the Finance Function

One of the most urgent challenges facing CFOs today is the talent gap. The U.S. accounting workforce is in decline. Over 300,000 accountants and auditors left the profession between 2020 and 2022, according to the Bureau of Labor Statistics.

Meanwhile, fewer students are choosing to study accounting. Even firms offering generous entry-level packages struggle to recruit and retain qualified CPAs. In this environment, outsourcing provides immediate access to experienced talent without the long hiring cycles or fixed overhead.

Whether filling in for senior accountants, supporting tax season, or maintaining financial reporting continuity, outsourced professionals act as an extension of the core team. Critically, outsourcing isn’t just a stopgap. It’s now part of the long-term workforce strategy for many finance departments.

2. Digital Transformation Is Accelerating and Outsourcing Helps Fuel It

Modern finance is no longer about periodic reporting—it’s about delivering real-time insight. Stakeholders want visibility, automation, dashboards, and scenario modeling. But implementing and managing digital tools like cloud ERPs or AI-driven platforms demands technical expertise many in-house teams don’t yet have. That’s where outsourced firms come in.

Accounting service providers increasingly specialize in technologies like QuickBooks Online, NetSuite, Xero, and SAP. Many offers end-to-end support: system integration, automated workflows, even analytics dashboards tailored to board-level reporting needs.

According to Deloitte’s 2024 CFO Signals report, 80% of finance leaders plan to expand automation across their functions (Deloitte CFO Signals, Q1 2024). For resource-constrained teams, outsourcing enables that innovation without the burden of recruiting niche tech-finance hybrids in-house.

3. Regulatory Complexity Is Driving Demand for External Expertise

Financial compliance is becoming more demanding by the quarter. From evolving IRS guidance to international tax rules and new ESG disclosures, the bar is rising fast. Outsourced accounting providers offer dedicated expertise in regulatory standards—whether GAAP, IFRS, SOX controls, or SEC reporting.

Many maintain audit-ready processes, approval hierarchies, and internal control frameworks by default. For businesses navigating multi-jurisdictional reporting, M&A events, or IPO preparation, outsourcing adds both capacity and credibility. It enables finance leaders to stay compliant while staying focused on growth.

Why the East and North Are Leading This Shift

The outsourcing trend is particularly pronounced in the East Coast and Great Lakes regions. These areas face unique pressures—high wages, premium real estate, and a sophisticated business landscape with low tolerance for operational lag.

High Cost of Doing Business

Cities like New York and Boston top national charts for average accounting salaries and office rental costs. For CFOs managing tight budgets, outsourcing offers a flexible way to scale up support without inflating fixed expenses.

Remote Work Has Leveled the Playing Field

The post-pandemic shift to remote and hybrid work has normalized the idea of off-site teams. With encrypted cloud tools, collaborative accounting platforms, and shared dashboards, finance professionals no longer need to be physically on-site.

According to a 2024 CFO Dive report, 74% of finance leaders now plan to permanently keep some roles remote. This cultural shift makes outsourced teams as viable—and in some cases, more effective—than expanding local staff.

Higher Expectations, Faster Turnaround

In fast-paced business environments, outsourced accounting firms often outperform internal teams when it comes to turnaround time and audit preparedness. Providers are built for throughput, scalability, and compliance. For firms that can’t afford inefficiency, outsourcing is the logical evolution.

The Real Benefits Businesses Are Seeing

Outsourced accounting providers are no longer just administrative back-office vendors. They now act as extensions of the finance function, offering specialized services and robust infrastructure that many mid-sized and even large companies struggle to build internally.

Here's the benefits they are seeing:

- Stronger Internal Controls: Standardized workflows, documentation trails, and built-in review protocols

- Continuity of Operations: Elimination of single-point failures when key staff resign or take leave

- Scalability: Surge capacity during audits, tax season, or growth initiatives

- Better Use of Internal Talent: In-house teams can shift focus from data entry to strategic planning

- Access to Specialization: Niche experts in tax, audit readiness, revenue recognition, and consolidation

These benefits go beyond efficiency. By offloading routine work and adding specialized support, outsourcing helps finance teams shift from reactive reporting to proactive strategy. It frees internal staff to focus on forecasting, decision support, and value creation—positioning finance as a true business partner, not just a back-office function.

List of Services

-

Is accounting outsourcing only for large companies?List Item 1

While Fortune 500 firms often lead the trend, mid-sized businesses increasingly rely on outsourcing to support seasonal needs, tech adoption, and compliance without bloating payroll.

-

Are outsourced accounting services secure and compliant?List Item 2

Reputable firms follow strict protocols in data encryption, role-based access, audit logging, and industry compliance standards such as SOX, GDPR, and HIPAA (if applicable).

-

Can outsourced teams handle specialized or industry-specific accounting?List Item 3

Many providers have experts in healthcare, real estate, SaaS, retail, and other sectors, covering revenue recognition, lease accounting, and complex consolidations.

-

How does outsourcing impact internal teams?List Item 4

Outsourcing empowers internal staff to focus on analysis, forecasting, and strategic work—while improving morale and retention by removing repetitive tasks.

-

Will outsourcing replace the need for a CFO or in-house controller?

Outsourcing complements leadership by freeing bandwidth and providing support. Strategic decisions and oversight still belong in-house.

Outsourcing Isn’t a Temporary Fix. It’s a Structural Shift.

Outsourced accounting is no longer a temporary fix—it’s a competitive advantage. In the face of labor shortages, rising expectations, and unrelenting regulatory pressure, companies are finding smarter ways to manage finance.

What was once considered an operational risk has become a strategic imperative. For forward-thinking CFOs, accounting outsourcing isn’t just about reducing costs. It’s about increasing capability, speed, and resilience in a changing world.

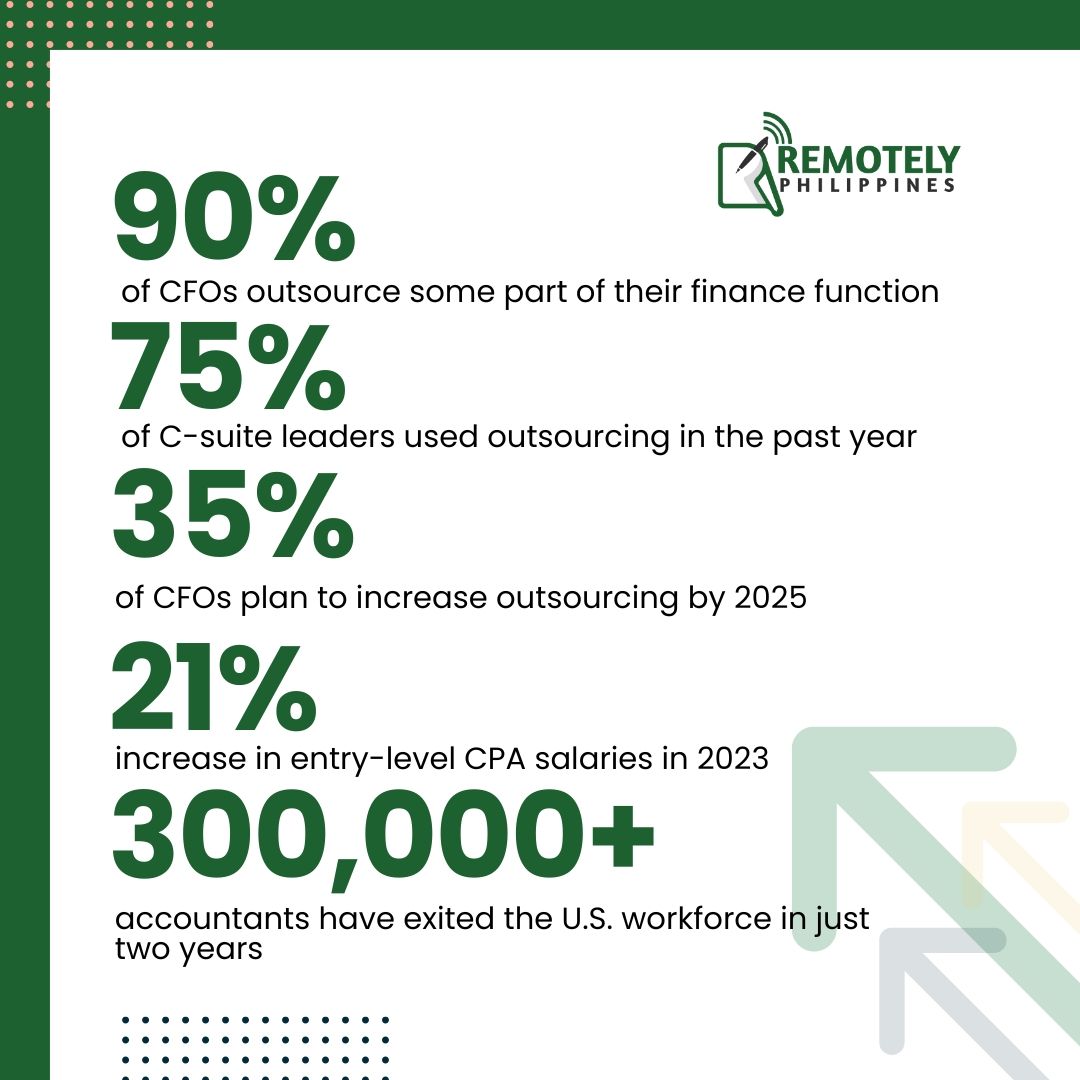

Behind every shift in business strategy is data—and these numbers we have discussed around accounting outsourcing reveal a powerful story.

- 90% of CFOs outsource some part of their finance function

- 75% of C-suite leaders used outsourcing in the past year

- 35% of CFOs plan to increase outsourcing by 2025

- 21% increase in entry-level CPA salaries in 2023

- Over 300,000 accountants have exited the U.S. workforce in just two years

This data signals more than a passing trend—it reflects a structural realignment in how finance functions operate. Where finance leaders once prioritized headcount, they now prioritize capability. Where geographic proximity once mattered, now it's about time zone alignment, quality controls, and specialized knowledge.

In this context, outsourcing is not a temporary fix—it's an intentional, long-term strategy for building a modern finance organization. Looking to build a more resilient, tech-enabled finance function?

Partner with us and discover how Remotely Philippines supports U.S. companies with scalable, secure, and strategic accounting solutions.

Sign up for our newsletter

Get regular curated content on management, outsourcing, and everything you need to know to stay ahead of the curve.